The incorporation of digital transformation into every facet of their business environment benefits insurance companies. However, plans for digital transformation are frequently hampered by the complexity of current legacy information technology systems. Integrating data from numerous platforms and organizational units can be challenging. Legacy systems can be a source of several integration issues, including the challenge of data conversion. You may also look for data conversion services for your insurance firm that are reasonably priced.

Before converting any data, it’s critical to understand how both the new and old formats hold data. It entails converting data from antiquated formats to current, accepted industry standards, allowing for better data accessibility and utilization within the organization. Data is essential, and insurance companies constantly collect massive amounts of data.

What’s Next?

Throughout the data translation process, integration issues can occur. Many businesses involved in the insurance industry face the integration difficulty of converting data from the widely used old spreadsheet format, XLS, to ACORD AL3, which has emerged as the industry standard. It can be quite helpful to automate this process as part of greater data automation efforts. It is best to outsource data conversion services from Tech2Globe at affordable prices.

Removing Outdated Data Types

Up until 2007, Microsoft’s XLS extension-based spreadsheets were the most popular and default Excel format. It was included in a wide variety of intricate, exclusive models developed by the actuarial, underwriting, and financial divisions. Additionally, adjusters and underwriters developed Excel spreadsheet templates for complaints and bids, which they still use today. However, just like other antiquated IT systems, the use of XLS has resulted in the technological debt. Although it was formerly a popular practice, it is today impeding and testing the insurance sector. The more modern and widely accepted industry standard for businesses to share data is the AL3 format developed by ACORD for the insurance sector.

Issue With Manual Data Conversion

Insurance firms invest a lot of staff time, money, and labour hours to successfully convert their reports from XLs format to AL3 manually. They can’t afford to divert vital time and resources away from crucial business activities because doing so would cause lengthy delays, reduced operational effectiveness, and billing delays, all of which would have a negative impact on customer satisfaction. Insurance firms frequently need to hire more personnel specifically for this role because manual process conversion is labour-intensive. The likelihood of human mistakes and absence increases when data is converted manually. This can result in expensive invoice and payment errors and losses for both the client and the business. When necessary, outsource data conversion services to avoid such issues.

Data Integration Requires Automated Data Conversion

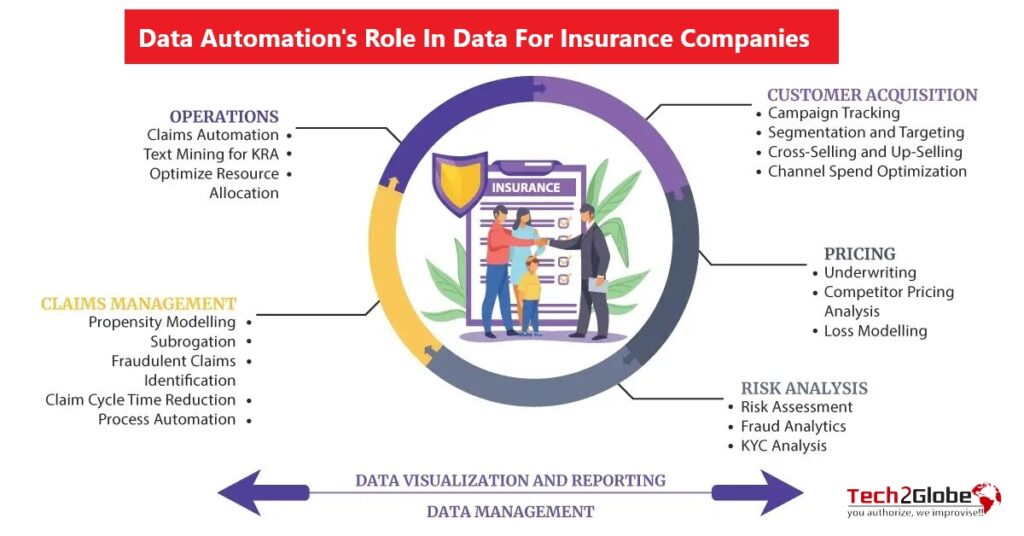

Insurance Claims Processing Services can enhance a variety of operational aspects of their business through better data visibility, accurate data entry, and efficient reporting when different data from various systems are merged. In order to properly solve the problems posed by data trapped into out-of-date and expensive forms, modern integration software must automate data conversion company.

Automating data management company could have several immediate benefits for businesses. Businesses can increase efficiency by focusing their time and resources on critical, value-added tasks. Data automation can speed up the procedure, improving performance and allowing insurance businesses to offer services more swiftly than in the past. The importance of rapid claim processing services for client retention is understood by insurance firms.

Conclusion

All organisational components in the insurance sector are built on data. Data integration and robots have emerged as the next critical step in moving the antiquated insurance sector into the modern digital era and giving their employees, suppliers, and, most importantly, their customers technological benefits. The greatest firm for specialised data conversion services is Tech2Globe, and you can also choose your insurance provider.